EquBridge X creates institutional account advantages and permissions, providing a unique trading experience and service for high net worth users and institutional groups in the securities market

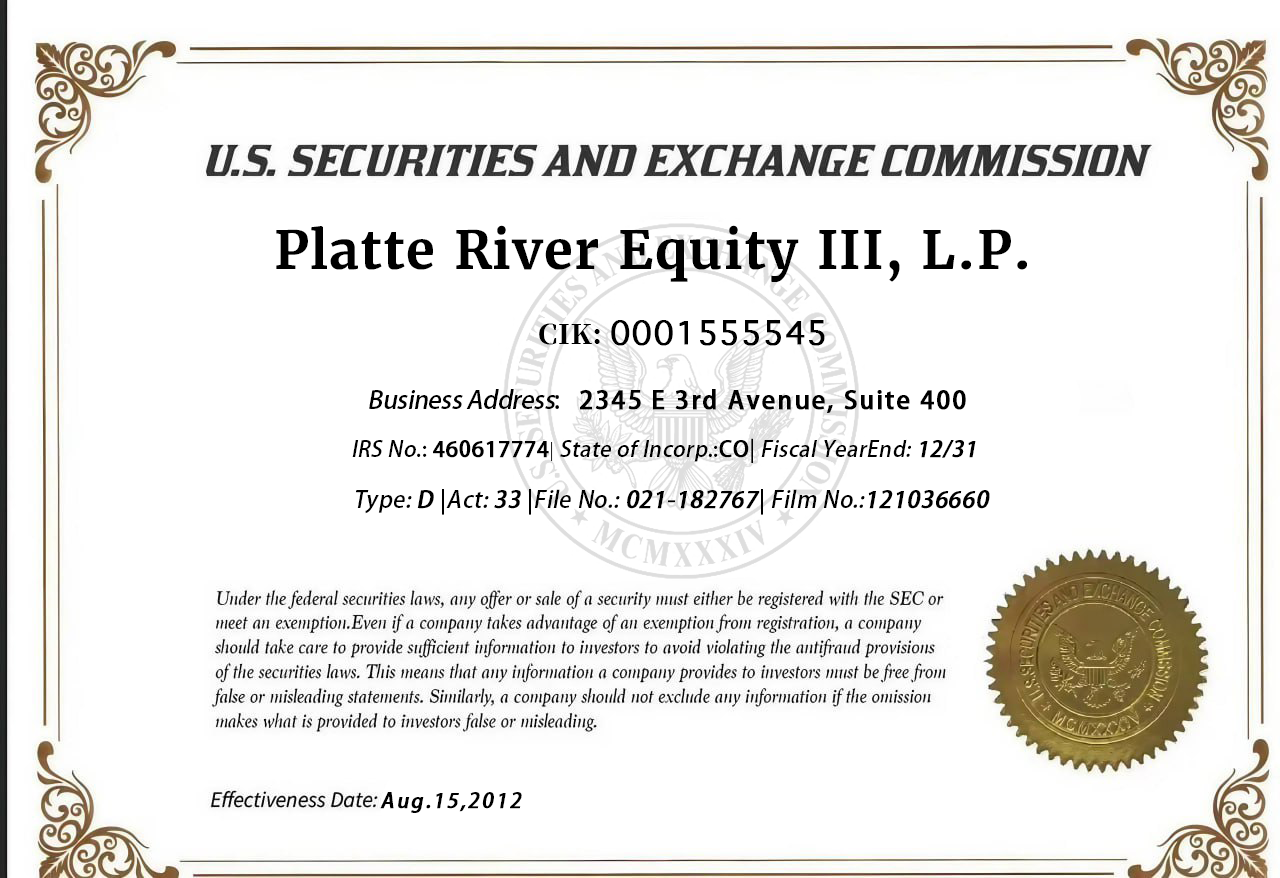

Platte River focuses on investing in industry sectors where its principals bring unique experience, relationships and insights.

Institutions & Consultants

Building portfolios that balance return with a level of risk that won’t keep you up at night

Institutional Strategy & Insider Information

Working with a broad range of taxable and nontaxable institutional investors and their consultants, we partner with what we consider to be some of the finest institutions both domestically and internationally.

Introduction to EquBridge X

In order to expand its business and enrich enterprise services, the company entered the securities and stock markets many years ago, establishing a favorable investment environment and comprehensive investment platform for global US stock investors. EquBridge X was born. We started our business in Asia and Europe in the early days and have now obtained authorization from relevant departments to conduct US stock market business globally. The platform currently operates in over ten countries worldwide. The platform includes comprehensive US stock trading, bulk trading, IPO and new stock subscription, etc. EquBridge X has significant technological advantages in institutional account application, general market trading experience, and IPO subscription rights compared to other ordinary platforms. It also has deeper research and innovation, which can bring customers more diverse experiences and rights. This business quickly gained popularity among global US stock investors.

Advantages of trading related products on EquBridge X platform

Combination of EquBridge X institutional account and regular account

The emergence of EquBridge X has a disruptive significance, as it not only possesses all the permissions and functions of a regular account, but also has the rights and advantages of more institutional accounts on the Youlian platform:

1: The subscription price for pre-market trading in the primary market is lower; Higher subscription success rate;

2: The success rate of offline new stock subscription is higher than that of online subscription;

3: Institutional accounts have dedicated investment advisors and research teams to provide customized investment advice and strategies for institutional clients;

4: Institutional accounts typically enjoy higher investment limits, allowing for larger trading and investment amounts compared to regular accounts;

5: Institutional accounts can use professional trading terminals, direct market entry functions, as well as more advanced trading software and quotation systems;

Block Trades

Refers to the transaction in which investors buy or sell securities for a large amount or quantity in the securities market. Such transactions usually involve larger amounts than ordinary transactions circulating in the market, and are often not conducted through the public market, usually directly matched by securities firms or exchanges.

Features:

Large transaction scale: The amount of bulk transactions is usually in the millions or even tens of millions.

Strong privacy: These transactions are usually not immediately made public, reducing their impact on market prices.

Pricing mechanism: The price of bulk transactions may differ from the market price, usually with a certain discount.

Advantages:

Reduce market volatility: Since bulk trading is not conducted through the public market, it can reduce the impact on prices.

Improve liquidity: Provide more flexible trading methods for large investors.

Applicable objects:

Bulk trading is typically suitable for large fund managers such as institutional investors, fund management companies, and insurance companies, but our EquBridge X perfectly addresses these issues by leveraging partnerships with institutional groups to better engage every individual retail investor!!

IPO new stock subscription

The process of a company issuing stocks to investors for the first time through a stock exchange to raise funds for the development of the enterprise. New stock subscription is aimed at obtaining a very low-risk price difference between the primary and secondary markets of stocks. Not only is the principal very safe, but the returns are also relatively stable, making it an ideal investment choice for stable investors.

Since 2019, a total of 125 companies have conducted IPOs in the United States, raising $14.708 billion with a first day increase of 64% and an average first day increase of 18.17%

In June 2020, two pharmaceutical stocks, LEGN.US and BNR.US, rose 60% and 50% respectively on their first day of trading on NASDAQ. On the day of its listing, (BLCT. US) $saw its highest intraday increase of over 100%. IPO new stock subscription has once again become a popular track for US stock investment.

In the past, IPO stocks in the US stock market were generally only open to clients of large investment banks such as Goldman Sachs, Merrill Lynch, and UBS. To become a client of these top tier investment banks, the asset size usually required at least $1 million. It can be said that this is not a game for individual retail investors. But with the rise of Internet securities companies, they can communicate with listed companies, wholesale new shares from underwriters, and then sell them to ordinary users, so that individual retail investors can also participate. Our EquBridge X can leverage the authority of institutional accounts to enable each user to obtain the optimal credit limit at the lowest price.